Printed circuit boards (PCBs) have a wide range of downstream industries, including communications, computers, consumer electronics, automotive electronics, servers, industrial control, military aviation, medical equipment, etc. The wide application distribution provides huge market space for the PCB industry and reduces the risks of industry development.

The requirements for high system integration and high performance of PCB products in the downstream field have promoted the continuous evolution and upgrading of PCB products in the direction of “light, thin, short, and small”; technological innovation in the PCB industry has also provided opportunities for the innovation of products in the downstream field.

With the continuous emergence of new technologies and applications such as cloud computing, big data, artificial intelligence, and the Internet of Things, as well as the large-scale advancement and commercialization of 5G network construction; the increase in the penetration rate of new energy vehicles, the degree of automotive electronics, autonomous driving technology and vehicle As the Internet continues to develop, the above-mentioned industries will usher in a new round of rapid development. Technological innovation in the PCB application industry and the development of emerging industries have brought new opportunities to the PCB industry and provided an important guarantee for the development of the PCB market.

Analysis and prospect forecast of PCB downstream market segment applications

(1) The electrification and intelligence of automobiles have continuously improved the electronic content of automobiles

Automotive electronics is the general term for body automotive electronic control and vehicle-mounted automotive electronic control. Driven by the four major trends of the Internet, entertainment, energy saving, and safety, the level of automobile electronics is increasing day by day. The automobile has evolved from a simple means of transportation into a comprehensive platform with multiple functions such as transportation, entertainment, and office.

Consumers are interested in safety body electronic products (such as brake assist system EBA, emergency anti-skid system ASR, electronic stability program ESP, smart parking, etc.) and infotainment products (such as car audio, car video, reversing vision system, car navigation ) has been increasingly recognized, and these products have entered a period of rapid development, directly driving the overall development of the automotive electronics market. The proportion of global automotive electronics in the cost of complete vehicles is increasing year by year.

Compared with traditional energy vehicles, the degree of electrification of new energy vehicles has increased, and the value of bicycle PCBs has increased. As ADAS develops towards high-end, the use of radars, cameras, etc. increases, and the proportion of high-end PCB products such as high-frequency PCB and HDI will continue to increase, which will further increase the value of PCB.

New energy vehicles have become the main direction of the transformation and development of the automobile industry and an important engine for promoting economic growth. Global new energy vehicle sales are growing rapidly, and the proportion of new energy vehicle sales in automobile sales continues to increase. Global new energy vehicle sales will increase from 540,000 units in 2015 to 10.52 million units in 2022, with an average annual compound growth rate of 52.72%. The global penetration rate of new energy vehicles will increase from 0.61% in 2015 to 12.89% in 2022, showing an accelerating upward trend. In 2023, China’s new energy vehicle production and sales will exceed 9 million units.

(2) With the development of display panels and new technologies, the demand for PCBs will usher in explosive growth.

The display panel industry has become the leader of the optoelectronic industry and is widely used in electronic equipment such as televisions, desktop computers, notebooks, and mobile phones. Global display panel shipments will continue to grow steadily from 2017 to 2022. With the upgrading of consumption, the trend of large-scale applications such as TVs, monitors, and smartphones on the demand side continues. Taking LCD TVs as an example, the average size of full LCD TVs in 2018 was 44.1 inches, and it is expected that by 2026, the average size will grow to 51.5 inches. The increase in panel size drives display PCBs toward larger sizes, expanding the demand for display PCBs.

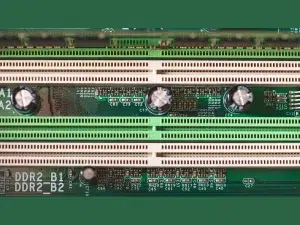

(3) The development of digital economy drives memory demand

Mini LED products have been released intensively since 2019. Manufacturers such as Apple, ASUS, TCL, Konka, Skyworth, and BOE have successively launched Mini LED-backlit display screens, TVs, car displays and other terminal products. Mini LED is beginning to usher in large-scale applications, and the demand for PCB will also usher in explosive growth.

The continuous development of informatization is an important driving force for the evolution and progress of storage devices. With the rapid development of digital transformation of enterprises around the world, data will show a trend of massive growth; the development of emerging technologies such as big data, cloud computing, artificial intelligence, and 5G communications is also making data sources and structures more complex and diverse. New data-based Products, new models, and new experiences are constantly emerging, and data has become one of the most important assets of an enterprise. It is expected that by 2035, the amount of data generated annually worldwide will reach 2,142ZB, approximately 45 times that of 2020.

The demand for storage devices brought about by the growth of data volume and the prosperity of the digital economy is highly rigid, and the market’s continuously improving requirements for data storage quality, transmission speed and other performance aspects are also driving the continuous progress of storage device technology, and the demand is iterating. and technology iteration will jointly promote the development of the memory market.

As cloud computing continues to be promoted globally, the data center industry as the basic IT infrastructure for cloud services will also continue to expand.

(4) Consumer electronics

In recent years, consumer electronics technology has continued to innovate, and the global consumer electronics industry has shown a sustained and stable development trend. Based on the iterative development of consumer electronics manufacturing technology and the popularization of mobile Internet applications, the global consumer electronics market represented by VR/AR, wearable devices, and smart homes has grown rapidly, and the consumer base continues to expand. The global consumer electronics output value in 2022 is US$337 billion, and is expected to grow at a compound growth rate of 3.4% from 2022 to 2027.

(5) Communication

Communication equipment mainly refers to communication infrastructure used for wired or wireless transmission, including communication base stations, routers, switches, backbone network transmission equipment, microwave transmission equipment, fiber-to-the-home equipment, radar, etc. Against the background of iterative upgrading of communication technology, popularization of smart devices and vigorous development of mobile Internet, the communication equipment industry has broad prospects. The global output value of communication equipment (excluding mobile phone terminals) will be US$236 billion in 2022, and is expected to grow at a compound growth rate of 3.8% from 2022 to 2027.